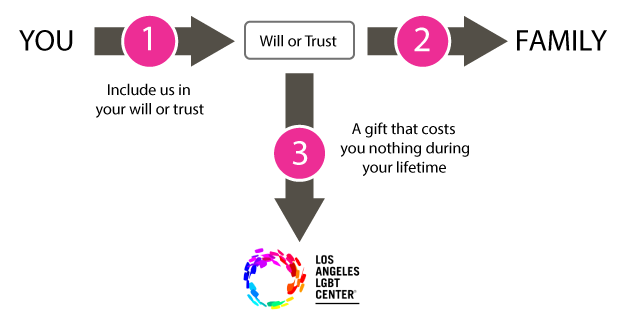

Gifts That Cost You Nothing Now

Gifts in a will or by beneficiary designation are two easy ways to build a world where LGBT people thrive as healthy, equal, and complete members of society — and they don’t cost anything now.

Gifts in a Will

Making a legacy gift in your will or trust is one of the easiest and most popular ways to make a lasting impact for the LA LGBT Center. By simply signing your name, you can create your legacy in the LGBT community.

Once you have provided for your loved ones, we hope you will consider making our important work part of your life story through a legacy gift.

A gift in your will is one of the easiest ways to create your legacy and offers the following benefits:

NO COST

Costs you nothing now to give in this way.

FLEXIBLE

You can alter your gift or change your mind at any time and for any reason.

LASTING IMPACT

Your gift will create your legacy in the LGBT community.

Four simple, “no-cost-now” ways to give in your will

General gift

A general gift in your will leaves a gift of a stated sum of money in your will or living trust, typically in the form of personal property or assets.

Specific gift

A specific gift in your will leaves the Center a specific dollar amount or stated fraction of your estate or specified items (collections, art, books, jewelry, and so on).

Residual gift

A residual gift in your will leaves the Center the remainder of your estate after other bequests, debts, and taxes have been fulfilled.

Contingent gift

A contingent gift in your will leaves the Center a stated share of your estate only if a spouse, family member, or other beneficiary does not survive you.

Gifts by Beneficiary Designation

You can support LGBT people for years to come when you name the Center as a beneficiary of your retirement account, life insurance plan, bank account, or other assets. This is one of the easiest gifts to give. It costs you nothing now, doesn’t require an estate plan or a lawyer, and you can change your beneficiaries at any time.

Reasons to Update Your Beneficiary Designations:

- You have been remarried, widowed, or divorced

- Your primary beneficiary has passed away

- Your financial institution changed ownership

- You had a grandchild or great-grandchild

- You want to create your legacy with the Center

Potential benefits of gifts by beneficiary designation:

Reduce or eliminate taxes

Reduce or avoid probate fees

No cost to you now to give

Create your legacy with the LA LGBT Center

To name LA LGBT Center as a beneficiary of an asset, contact the custodian of that asset to see whether a change of beneficiary form must be completed.

How to change a beneficiary designation:

Login to your account or request a Change of Beneficiary Form from your custodian (the business holding your money or assets).

Follow the links to change your beneficiary or fill out the form.

Be sure to spell the name of our organization properly: Los Angeles LGBT Center

Include our tax identification number: 95-3567895

Save or submit your information online or return your Change of Beneficiary Form.

Types of Gifts

A gift of retirement funds

You can simply name the Center as a beneficiary of your retirement plan to care for, champion, and celebrate LGBT individuals and families in Los Angeles and beyond.

A gift of funds remaining in your bank accounts, brokerage accounts or certificate of deposit (CD)

This is one of the easiest gifts to give and one of the most useful in accomplishing your philanthropic goals. The next time you visit your bank, you can name the Los Angeles LGBT Center (Tax ID: 95-3567895) as the beneficiary of a checking or savings bank account, a certificate of deposit (CD), or a brokerage account. When you do, you’ll take a powerful step toward protecting the rights of LGBT people for generations to come.

Donor-Advised Fund (DAF) residuals

What remains in a donor-advised fund is governed by the contract you completed when you created your fund. When you name the Los Angeles LGBT Center as a “successor” of your account or a portion of your account value, you help us build a world where LGBT people thrive as healthy, equal, and complete members of society.

Creative Ways to Make a Major Impact

Complimentary Gift Planning Resources are Just a Click Away!